21Steps Free Crypto Course with AI Analysis Tips

Already in crypto market?

Even if you’re already active in the crypto space, the free 21steps offer valuable insights to deepen your understanding and sharpen your strategy.

Learn First, Then Earn

Start with structured education before trading or investing. These steps build your foundation in blockchain, market dynamics, and crypto essentials—so you can earn with confidence.

Crypto Literacy for all

Whether you invest or not, understanding crypto is key in a decentralized world. It helps you stay informed, support others, and lead in tomorrow’s digital economy.

Your Crypto Journey

Your cryptojourney starts here. Master the 21steps and unlock paths to earning, teaching, analyzing, or creating. This isn’t just a course—it’s your launchpad to impact and income in the crypto world.

No compliments

Through years of experience across financial and commodity markets, I’ve consistently observed critical gaps in knowledge and awareness among market participants—whether entrepreneurs, customers, or aspiring startup founders. These blind spots often lead to missed opportunities, costly mistakes, and avoidable risks.

Many people make costly mistakes in trading, investing, or starting businesses due to lack of education or expert advice. I’ve seen it happen often—and experienced it myself. That’s why I emphasize learning and mentorship as essential tools to avoid losses and make smarter, more profitable decisions.

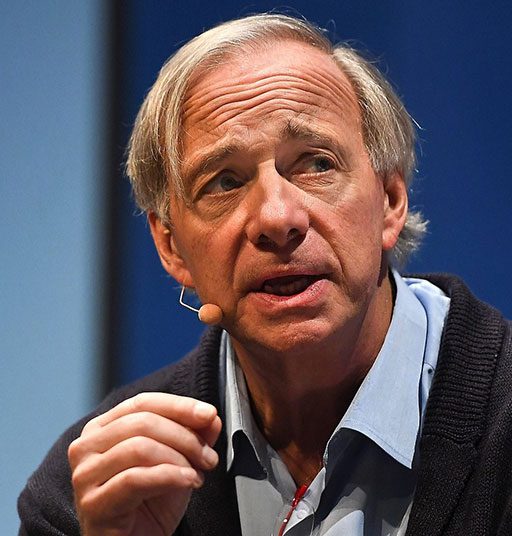

There are two paths to success: 1. Have what you need, or 2. Get it from others. The second path requires humility. The best way is to have both.

Ray Dalio - Principles

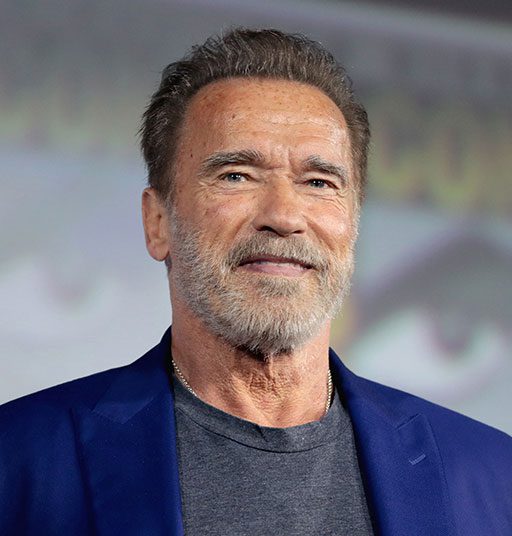

I came here with absolutely nothing. On Thanksgiving, the gym's bodybuilders came to my apartment and brought me pillows, dishes, and everything I didn't have. None of us can make it alone. Call me whatever you want, but don't ever call me "self-made." Without help, I would never have made it in life.

Arnold Schwarzenegger

Establishment of the CryptoMentor Academy

I created the 21steps crypto education path out of a sense of mission and responsibility—to help anyone enter the cryptocurrency market safely, confidently, and profitably. Through free resources and the advanced course at Cryptomentor Academy, learners gain the tools to research, plan, and build their own trading strategy.

Many people lose money simply because they skip education or expert advice. I’ve made those mistakes too. That’s why I’m here—to guide you step by step, answer your questions, and help you avoid costly errors through smart, informed decisions.

What is Blockchain and Bitcoin?

Step 1 - What is blockchain?

Blockchain is a decentralized digital notebook (ledger) storing data securely across networks, enabling trustless transactions and transparent record-keeping.

Step 2 - What is Bitcoin, cryptocurrency, and digital currency?

Bitcoin is a decentralized cryptocurrency; digital currencies are electronic money, while cryptocurrencies use blockchain for secure, peer-to-peer transactions.

Why invest in blockchain and cryptocurrency?

Step 3 - Blockchain Jobs

Blockchain careers include developers, analysts, educators, marketers, and legal experts driving innovation in decentralized systems and crypto ecosystems.

Step 4 - Bitcoin and Cryptocurrency Market Performance

Crypto market performance reflects price trends, volatility, adoption, and investor sentiment across Bitcoin and altcoins over time.

Which cryptocurrency should we buy?

Step 5 - Fundamental Analysis of Bitcoin and Cryptocurrencies Using AI

Smart fundamental analysis evaluates crypto value using technology, team, utility, adoption, AI and macroeconomic factors—not just price charts.

Step 6 - Tokenomics or Token Economy

Tokenomics studies a crypto token’s supply, demand, utility, incentives, and distribution to assess its long-term sustainability and value.

Step 7 - Supply and Demand in the Cryptocurrency Market

Crypto prices fluctuate based on token supply, user demand, scarcity, and market psychology, core economic forces in action.

When should we buy Bitcoin or cryptocurrency?

Step 8 - Technical Analysis of Bitcoin and Cryptocurrencies Using AI

Smart technical analysis uses AI, price charts, indicators, and patterns to predict future crypto movements and trading opportunities.

Step 9 - Trendline in Technical Analysis

Trendlines connect price highs or lows to visualize market direction, helping traders identify bullish or bearish momentum.

Step 10 - Support and Resistance in Technical Analysis

Support is a price floor; resistance is a ceiling. These levels help predict reversals or breakouts in crypto charts.

Step 11 - Buy or Entry Signal in Technical Analysis

Entry signals suggest optimal buying points using price action breakouts, indicators like RSI, MACD, or candlestick patterns for timing trades.

How much Bitcoin or cryptocurrency should we buy?

Step 12 - Investment Management and Portfolio Management in the Cryptocurrency Market Using AI

Smart crypto portfolio management involves asset allocation, diversification, rebalancing, and strategy to optimize returns and reduce risk.

When to sell Bitcoin or cryptocurrency?

Step 13 - Risk Management, Stop Loss and Take Profit

Smart risk management sets stop-loss and take-profit levels along with AI to protect capital and lock gains during crypto market volatility.

How to top up your cryptocurrency wallet?

Step 14 - Cryptocurrency Wallet and Its Security

Crypto wallets store private keys securely. Security includes encryption, backups, and avoiding phishing or malware threats.

Step 15 - Receive Cryptocurrency and Bitcoin in a Cryptocurrency Wallet

To receive crypto, share your wallet address. Funds are transferred securely via blockchain to your digital wallet.

Step 16 - Cryptocurrency Transfer Network and Network Fees

Crypto transfers use blockchain networks like Ethereum or Bitcoin, with fees paid to miners or validators for processing.

Step 17 - Recover Cryptocurrency Wallet

Wallet recovery uses a seed phrase. Losing it means losing access—always back it up securely and offline.

How to buy or sell Bitcoin or cryptocurrency?

Step 18 - Register with a cryptocurrency exchange, verify your identity and KYC

Sign up on an exchange, complete identity verification (KYC) to comply with regulations and unlock trading features.

Step 19 - Transferring Cryptocurrency to/from a Centralized Exchange

Centralized exchanges let users send their digital assets to the exchanges’ custodial wallets, and vice versa.

Step 20 - Types of orders on a cryptocurrency exchange

Order types include market, limit, stop-loss, and OCO—each controls how and when trades execute based on price.

Step 21 - Cryptocurrency Swap

Swapping exchanges one crypto for another instantly, often using decentralized platforms or built-in wallet features.

Throughout your journey in the 21steps free crypto pcourse, my deepest wish is for each of you to achieve lasting profitability—whether you're investing, trading, or simply building your understanding of financial markets, especially the dynamic world of cryptocurrency. This path is designed not just to inform, but to empower you to act with confidence, clarity, and purpose.

MAHDI BML

Crypto and Blockchain Events

If you are interested and looking for more complete details and mentorship, you can participate in the 21steps crypto event at AMWAJ company.